When you see that your credit score is low, you may think that you won’t be approved to get a mortgage. However, some lenders provide financing to borrowers with relatively low credit scores to buy a house. First of all, let’s understand what a credit score is.

A credit score (in Canada) is a three-digit number ranging from 300 to 900 that indicates a borrower’s creditworthiness based on the statistical analysis of an individual’s credit report provided by credit bureaus. The higher your credit score is, the better it is for you as it shows how credible and responsible you were as a borrower before. Lenders are more likely to finance you whenever you have a good credit score. But what qualifies as a good credit score? Is 600 a good credit score, for example?

What Is a Credit Score of 600 Considered?

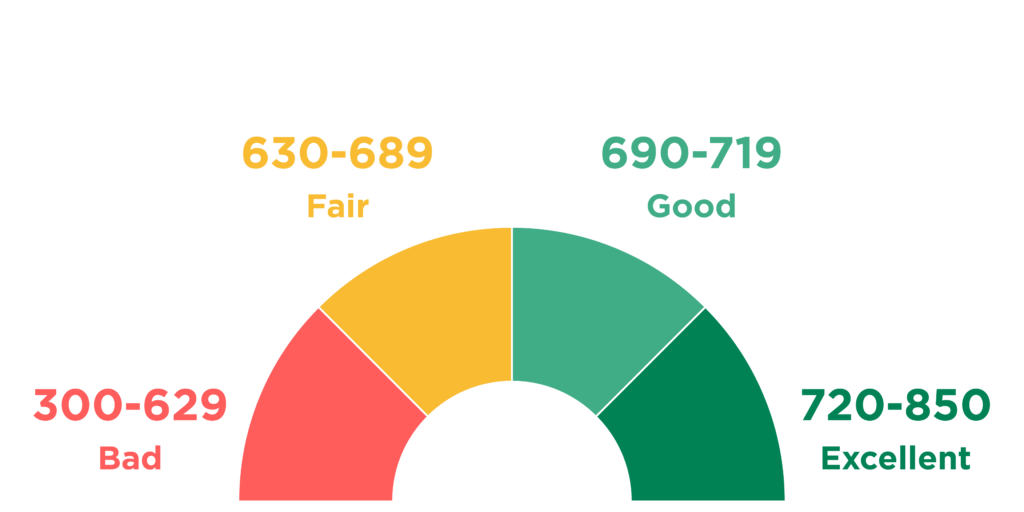

What is a good credit score to get a mortgage? Here are the Canadian credit score ranges to show which score is good or bad:

- Exceptional: 760-900

- Very good: 725-759

- Good: 660-724

- Fair: 560-659

- Poor: 300-559

Is 600 a good credit score, then? Considering the above-mentioned digits, we see that a 600 credit score can be considered a fair score. Typically major banks require a credit score that is above 600.

What Credit Card Can You Get With A 600 Score?

You may wonder whether you can apply for a credit card with a little over a 600 credit score. What if you have a 602 credit score to get a credit card? Is 602 a good credit score for that? Maybe you have a 609 credit score. In Canada, the small fluctuations in number are not as significant as long as they fall under the corresponding ranges mentioned above.

Most card providers of Canada consider a credit score of 650 to be satisfying, and people with scores higher than this have no trouble getting approved for a credit card. Those with credit scores below 650, on the other hand, may have some difficulties. After knowing this, applying for a credit card with a 600 credit score seems unrealistic, right?

Here are some credit cards that you can apply for with a 600 credit score:

- Secured credit cards

- Prepaid credit cards

- Student credit cards

- Retail credit cards

These types may also assist in building your credit score.

What Is The Minimum Credit Score For A Mortgage In Canada?

What is the right credit score to buy a house? In general, the minimum credit score for a mortgage in Canada is 640 or anywhere between 620 and 680, however, it depends on the lender. For example, having a 610 credit score for a mortgage is considered low. But, there are private mortgage lenders that may drop that requirement down to 500 as a minimum credit score for a mortgage and may approve your application.

What Factors Do Lenders Look At Except For a Credit Score?

Lenders consider more than just your credit score to approve or deny your application. Even if you have a 600 credit score or above, your lender looks at your credit report as well, and when they notice a history of debt and payment issues, then they may reconsider approving you a mortgage.

Here are some of the aspects that lenders may look at except for a credit score for a mortgage:

- Income

- General expenses

- Employment history

- The money you want to borrow

- Current debts

- Amortization period

They will examine your overall debt load, including car payments, credit card payments, student loans, etc. and can calculate your monthly costs for housing, including potential property taxes, utilities, potential mortgage payments, and more.

Can You Buy A House With A Bad Credit In Canada?

Here are some tips for you if you have a poor credit score to get a mortgage:

Find a private mortgage lender – If your credit score falls below the bank’s minimal credit score for mortgage approval, such as having a credit score below 600, you’ll need to opt for credit unions, subprime lenders, private lenders, and trust companies. These financial institutions are specialized in assisting borrowers with poor credit scores to get a mortgage.

If you’ve passed through a consumer proposal or bankruptcy within the last two years you will need to opt for private mortgage lenders. You must know that if you plan to apply for a mortgage with a credit score below 600, you most probably will pay a higher interest rate than if you had a higher credit score and applied with a traditional lender. You can opt for an experienced mortgage broker, like Jodi Habel, to help you find the best mortgage option for your credit score and overall financial standing.

Opt for a joint mortgage or a co-signer – If you have a poor credit score to buy a house, you need to have a co-signer. During a co-signed mortgage, there is a third party who acts as a mortgage guarantor. If you can’t make your monthly mortgage payments, the co-signer guarantees to do so. Whenever you have a bad credit score to get a mortgage, having a co-signer will be beneficial for you to access better mortgage rates. A co-signer is a co-borrower, whose income and credit score are taken into account during the mortgage application process.

However, you should know that a co-signer has responsibility for your mortgage and if you don’t pay for your mortgage monthly, then they have to do it for you. They are financially responsible, hence, their credit history will be impacted too if you fail to make your installments on time. Thus, those who agree to be your co-signers are mostly related to you, such as your siblings or parents.

Also, in most situations, your co-signer will be required to become a part-owner of your house, which can lead to conflicts among co-signers, particularly when it comes time to sell the house. Another option you can consider is a joint mortgage which typically involves two or more people owning and living in the same home, though this is not always the case.

Consider a larger down payment – As you’ve seen above, lenders look at many factors besides credit score for a mortgage in Canada. The minimum down payment in Canada is 5% of the home’s purchasing price but the majority of banks anticipate at least a 20% down payment. If you have a poor credit score to buy a house, your lender may require a larger down payment because lending to you is riskier.

If you save a 20-25% down payment, you can show that you are financially secure enough to buy a home, but it also decreases your monthly mortgage payment.

Improve a credit score to get a mortgage – Even though there are options to get a mortgage with a poor credit score, you should think of improving your credit score to buy a house. Through improving your credit score to get a mortgage, you’ll boost your chances to secure a mortgage with a reduced interest rate.

Credit Score Is 580, How To Improve It?

If you want to buy a home, a credit score is essential. And here are some tips for you to improve your credit score to get a mortgage:

- Pay your bills on time.

- Maintain a utilization ratio of less than 30%.

- Establish a long credit history.

- If you don’t have any credit history, you can become an authorized user on a credit card belonging to a family member or a friend, or you can get a secured card.

- Don’t make a habit of opening new accounts frequently.

- Have a good credit mix.

Now you know how essential it is to have a good credit score to buy a house. Don’t hesitate to opt for Jodi Habel Mortgage Broker to assist you in getting pre-approved for your mortgage.

I have over fifteen years of experience and have worked with various clients having different credit scores. As I access a variety of banks and lenders, I can help you discover the ideal mortgage for your credit score.